Secured Loans – The Safest Way To Grab Finances

A secured loan is where the customer concedes to offer the lending institution some kind of security. When it comes to secured loans in the UK, commonly the safety and security will definitely be actually the residential or commercial property of the loan applicant. In various other words, loans for which you have actually provided the loan provider a charge on residential or commercial property like an automobile, watercraft or even other personal effects or realty would work as a security for the loan equity release.

The financial institutions experience a lot less unsafe while providing such loans due to the fact that they have safety and security along with all of them. As these loans are actually secured in manner, the loan provider possesses a sense of safety which will offer you loan at really reduced interest rates and that too with simple repayment possibilities.

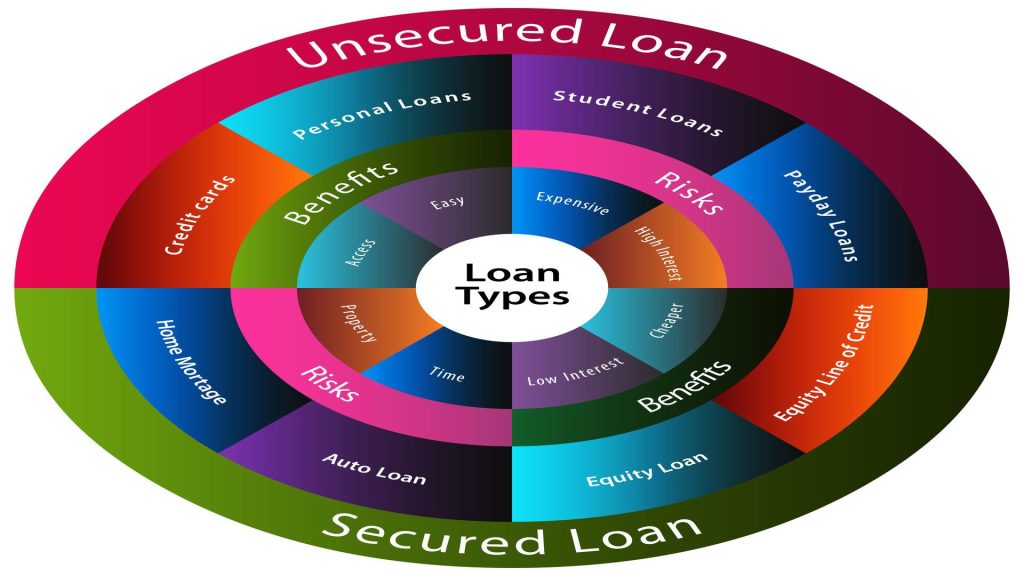

There are actually plenty of sorts of secured loans available, which depends on the amount you yearn for as well as the security you want to earnest. The secured financial obligation consolidation loans, secured personal loans and secured organization loans are actually handful of which drop under this bracket of secured. These form of loans are provided by countless banks and banks these days and also too at quite budget friendly prices of rate of interest. The financial institution delivers loan to the consumers as a type of loan and the consumer repays this loan in quantity. However usually, the remittance will certainly perform the basis of regular monthly instalments. All your financial and individual criteria can easily be actually conveniently addressed along with these sorts of loans.

These type of loans have actually been actually produced for those that require funds urgently. There are many programs, which supply loan quickly, these programs seem to happen with big benefits over the others as it lugs a lesser passion rate as compared to other loans. Immediate secured loans are the same as other secured loans, apart from that they remove several variables, which quicken the loan confirmation method. For instance, facility of using the loans are offered online. You may easily apply for these loans without needing to drive to the lending institution’s workplace. You can browse through to the sites of the concerned financial institutions or financier any time and after that fill-up the free of cost application.

The loan financial institution holds out the process of proof as soon as you send the document. If you are actually thinking about utilizing this loan to combine your debts, you may be ensured by the loaner to use it as well as spend off every financial debts without any sort of hassles. These loans are provided at reduced and budget-friendly rates of interest as they are backed up through protection. You can make use of these loan quantities for meeting many financial needs. You may additionally use the funds for instructional objective, getaway, wedding purpose, acquiring automobile or even for home design, combining financial debts etc. There are actually no constraint on the consumption of these loan amounts. You may also use the funds money to buy your business and extend it.